Soarion Credit Union Members need to Login to Digital Banking and select "Accounts" > "Open an Account" to apply

Go to Digital Banking

Soarion Credit Union - Braun Pointe Financial Center, San Antonio, TX

The full-service credit union in San Antonio, TX, where your financial wellness soars. Open accounts, make deposits and withdrawals, apply for loans, access 24/7 Drive Thru ATM, and much more.

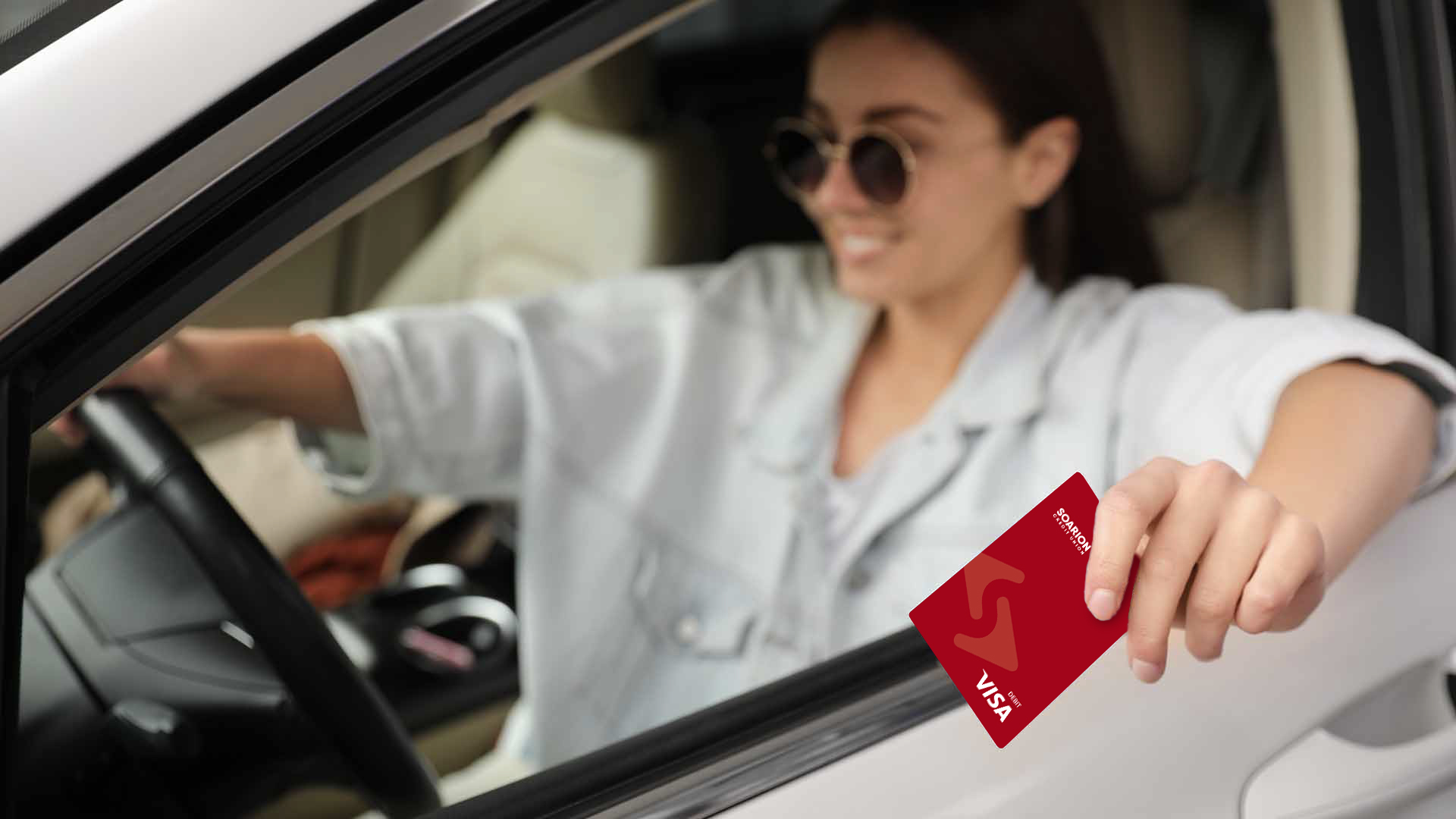

About Soarion Credit Union

We are a member-owned federal credit union, born and raised in San Antonio, Texas. Since our beginnings serving local airmen in 1952, we have provided financial lift to tens of thousands all around the world through simple products, a consistently improving and responsive member experience, and complimentary financial literacy & education. From everyday checking to savings for the future, from your first car loan to buying a home for your growing family, we are there to lift you to new financial heights. Ready to soar? Visit us at your nearest Financial Center, open an account through Digital Banking, or call us at (210) 673-5610.

Lobby Hours

Monday - Friday

9:00am – 5:00pm

Saturday

Closed

Drive Thru Hours:

Monday - Friday

9:00am – 5:00pm

Saturday

9:00am – 1:00pm

We’d Love to Hear From You!

We hope you're enjoying your membership! If you're having a great experience with us so far, we'd love you to write a few words in a Google review or Yelp review.

If your experience could have been better, consider giving us feedback through secure message, phone, or visiting a branch.

We exist to make managing your finances easy. Our goal is to live up to your expectations and earn your five-star review. If we fall short, we like to know what happened and how we can make it right. We treasure your feedback, as it helps us continue doing what's best for you. We'll use your comments to improve our products and services so that you always leave our financial center at Braun Pointe with a smile.

Other Account Options at Our Braun Pointe Financial Center

As your local credit union in San Antonio, TX, we’re proud to offer our members two checking options and a wide range of savings accounts, vehicle loans, personal loans, and lines of credit.

Ready to Join Soarion Credit Union?

Joining is easy. You can apply online, anytime, anywhere. Or stop by one of our Financial Centers.

Enjoy Banking at Your Fingertips with Digital Banking

Soarion Credit Union's Digital Banking gives you the power to manage your finances on the go with your web browser or with the Soarion CU Mobile App.

-

Credit Card Application Disclosure

-

Credit Card Terms and Conditions